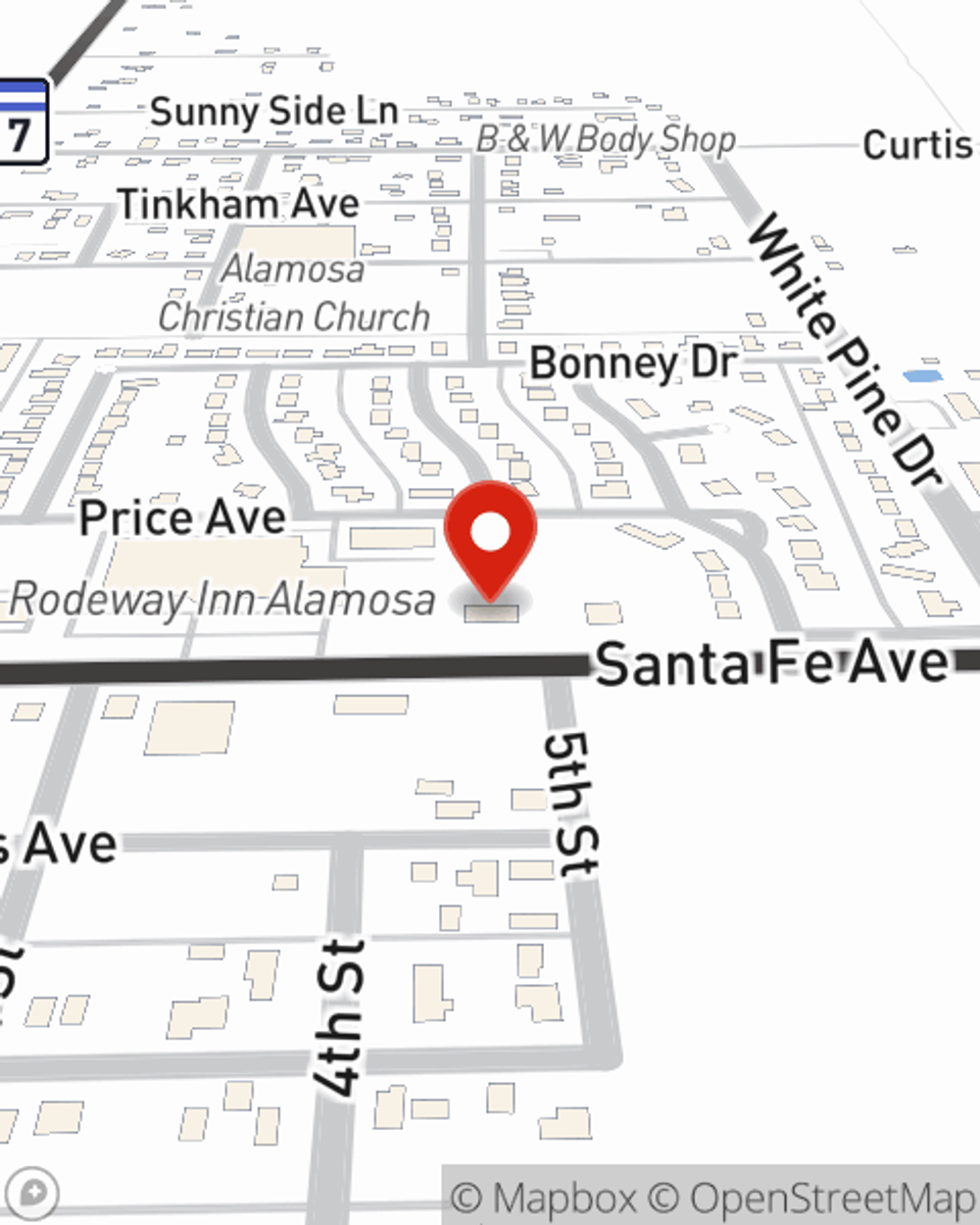

Renters Insurance in and around Alamosa

Welcome, home & apartment renters of Alamosa!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Alamosa

- Monte Vista

- La Jara

- Manassa

- Crestone

- Creede

- Fort Garland

- South Fork

- Antonito

- Center

- Poncha Springs

- Salida

- La Veta

- Walsenburg

- San Luis

There’s No Place Like Home

Your rented space is home. Since that is where you relax and make memories, it can be a wise idea to make sure you have renters insurance, even if your landlord doesn’t require it. Even for stuff like your video games, smartphone, stereo, etc., choosing the right coverage can help protect your belongings.

Welcome, home & apartment renters of Alamosa!

Renters insurance can help protect your belongings

Why Renters In Alamosa Choose State Farm

Many renters underestimate the cost of replacing their belongings. Your valuables in your rented space include a wide variety of things like your smartphone, tool set, set of favorite books, and more. That's why renters insurance can be such a good move. But don't worry, State Farm agent Torben Walters has the dedication and experience needed to help you examine your needs and help you keep your belongings protected.

Don’t let fears about protecting your personal belongings keep you up at night! Get in touch with State Farm Agent Torben Walters today, and find out the advantages of State Farm renters insurance.

Have More Questions About Renters Insurance?

Call Torben at (719) 589-9031 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Torben Walters

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.